Looking for South Western Sydney conveyancing? We’ve been serving Liverpool, Macarthur, Narellan, Penrith and surrounding area residents and businesses for almost 30 years.

We pride ourselves on our commitment to placing our clients first.

You can be at peace knowing we have your interests at heart as we provide transparent, fixed fees as well as full service, independent advisory.

Why do our clients keep choosing us as their preferred Liverpool, Penrith and Macarthur conveyancers:

- Local area experts: our strong familiarity with the Liverpool market and South Western and Macarthur suburbs which includes Narellan and Penrith will help you avoid costly errors

- Almost 30 years of legal experience

- Complete transparency

- Fixed fees in writing, no hidden costs

- Your interests are our priority

- Exceptional team dedicated to you

- Free, cutting edge online platform that guides you through (and lets you monitor) the entire conveyancing process

- We’re licensed and fully insured

Why is conveyancing important?

Conveyancing is complex and fragmented by nature, the transfer of a property can lead to disastrous consequences if not done correctly. An error in paperwork or inaccurate, careless conveyancing could result in the loss of your deposit, or worse yet, your property all together as well as legal costs and damages on top.

Our well experienced team knows the ins and outs of property law. Our repeat clientele and focus on integrity allows us to approach your conveyancing with accuracy, transparency and incomparable professionalism.

There are numerous factors involved with property transactions. Our main role is to help you make your transaction a legal reality.

We:

- Provide legal advice and support

- Represent you in negotiations

- Review your contract

- Lodge your legal documentation

- Lodge rates, tax and council certificates

- Provide necessary searches for your property

- Draw up your contract of sale (if selling)

- Manage and help actualise the title transfer

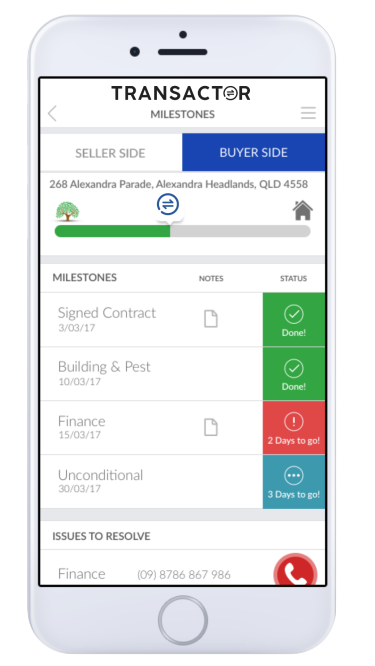

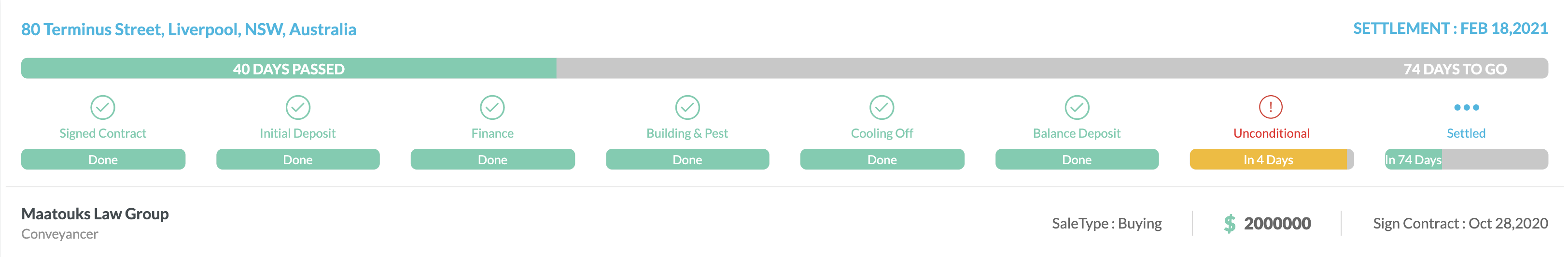

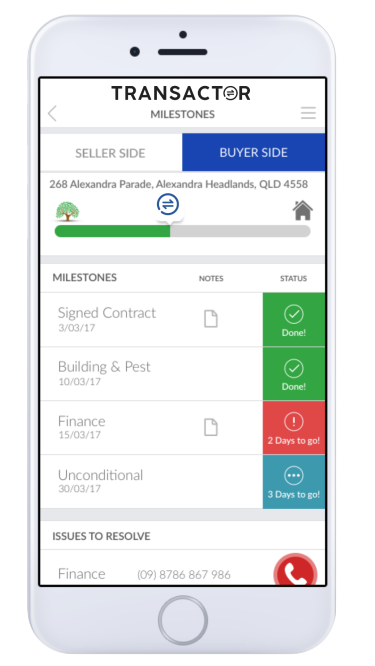

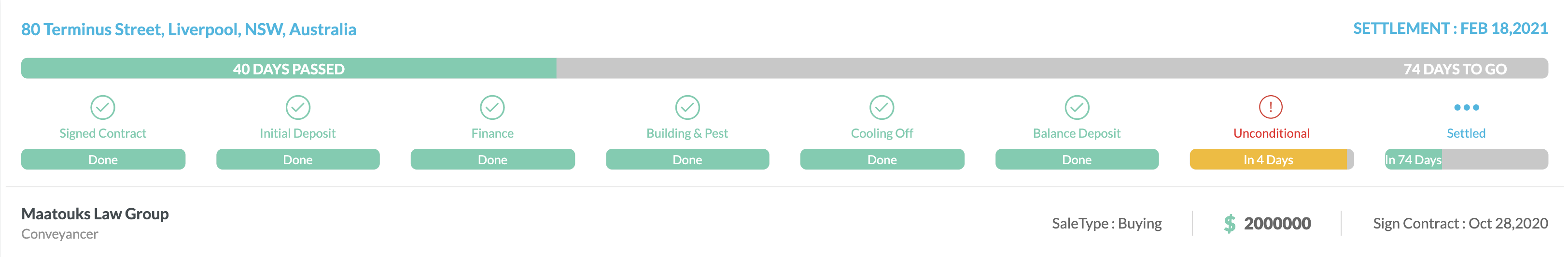

We also have our own platform Transactor – this tool will help you visualise the entire conveyancing process so you can track the progress live 24/7.

Sydney Conveyancing

The conveyancing process in Sydney, New South Wales, differs from other Australian states. As a Sydney conveyancing firm, we understand the intricacies of New South Wales property law and how it can apply to Liverpool residents.

Our offices are located right in the hearts of Liverpool, Narellan and Penrith. As such, whether you’re a local resident, business owner or outside investor looking to buy or sell real estate in these areas and surrounds, you can use our local expertise to your advantage.

Services in detail

We provide legal support for a range of circumstances and needs. This includes:

- Buying and selling residential properties, including land

- Buying and selling commercial properties, including land

- Property transfers (such as transferring properties to business partners, spouses and relatives)

- General conveyancing

- Wills and estates

- Power of attorney

- Property refinancing

- Insurance

- Residential and commercial leasing

- Business law

- Franchising

- Binding financial agreements

- Farming development

- Purchasing off-the-plan properties

- Mortgage guarantors

- Property subdivisions

- Subdivision lodgements

Transparency and convenience

As mentioned above, your needs are our priority. Unlike other conveyancers, we like to make our processes as transparent as possible. Our clients will have access to Transactor: a revolutionary app that enables users to track their entire property journey, live, 24/7.

Transactor also enables our clients to communicate and collaborate with all other suppliers needed to complete their transactions, such as agents, building and pest inspectors and more – all in one dashboard.

Because contracts are crucial to the conveyancing process, Transactor uses patented technology to automatically extract all the terms and conditions of a contract and convert it into scheduled timelines and to-do lists that can sync with your calendar

Liverpool, Narellan and Penrith Conveyancers – get a free quote.

Looking for conveyancers you can trust?

Contact us today for a free quote.

Get a Free Phone Consultation Now

Want to learn more about the conveyancing process?

Learn more

Buying or selling a residential or commercial property is a significant matter in most peoples’ lives. For some people it is the most significant transaction they will ever undertake.

Maatouks Law Group have been acting for purchasers and sellers of residential and commercial property for many years.

- Torrens Title

- Old System Conveyancing

- Company Title

- Rural Land

- Commercial And Industrial Leasing

- Residential Leasing

- Leasing Disputes

- Advising On And Drafting Easements, Covenants And Disputes Over Easements

- Property Development And Associated Aspects Such As:-

- Strata Title Disputes

Conveyancing Process For Buying A Property In NSW

The conveyancing process for buying a property is explained below for your understanding.

Pre exchange

Offer and acceptance

Once an offer has been put by you and accepted by the vendor , we will advise you to provide us with the Contract of Sale from the agent or vendors solicitors.

Contract

The Contract of Sale contains all the details of the property such as the settlement period which is usually 42 days, the description of all the inclusions being sold with the property, a copy of a Title Search stating any mortgages, easements, restrictions, etc that effect the use of the property.

Further, a zoning certificate is annexed to the contract which states the Council Zoning, and whether the property is under commercial or a residential zone, and the permitted development usages applicable to the property.

Lastly, the contract consists of a drainage diagram which shows, if and where the main sewer crosses the property.

Pre-exchange reports

The contract only covers aspects like title searches, etc but does not disclose the structural quality of the house. We advise all our clients to obtain a Pest, Building or a Strata Report (for Strata properties) if required for the property.

Think about it, people often pay for an NRMA report when they want to buy a second hand car, well the cost of a building or pest report is not that much more and you have so much to lose if you buy a house that has problems or issues that you were not aware of.

A building report can reveal what an untrained eye cannot e.g. problems with the drainage, extensions, etc. A pest report can show if the property is infected by termites or white ants etc.

A building and a pest inspector will be able to determine how serious the problems are and will be able to provide a rough estimate of the costs involved to rectify the above problems which in return can help you in renegotiating the purchase price if required.

Strata Report

A Strata Report is carried out for Strata Properties, i.e. for Units, Townhouses, or villas and provides information like any problems that other lots/units might have in the strata, insurance, any special levies being charged.

It can also be a great insight for you with respect to the Strata location itself. For example the report may disclose that thousands of dollars are being spent every quarter to clean graffiti or replace broken windows, this would indicate to you that the location may not be what you thought it was and you can consider not proceeding with the purchase.

Finance

Before you sign the contract, you should apply for a loan and at the very minimum obtain a conditional loan approval. This means that the bank has indicated to you that you should be able to obtain finance subject to meeting their various requirements. This is risky as the bank can always turn around and state that you do not qualify for a loan. You should NEVER unconditionally exchange contracts without having full unconditional loan approval.

Exchange

Exchanging the contract

Once we have reviewed the contract and the inspection reports, we will advise you of any amendments that we will require to negotiate with the vendor’s solicitor/conveyancer for your benefit and will proceed to exchange the contracts with your approval.

Cooling off Period

Every contract for residential property contains a five business day cooling off period which means that the purchaser has five business days to decide whether they wish to proceed with the purchase of the property or not. The vendor does not have the right to change their mind during the cooling off period.

The decision of the purchaser to proceed or not largely depends upon factors like obtaining final loan approval from the bank, obtaining pest and building reports if not done earlier, having the contract reviewed by the Solicitor if not done previously and seeking their advice.

The cooling off period also gives time to the purchaser to arrange their 10% deposit which is payable before 5:00 pm on the fifth business day. The cooling off period can be extended with the consent of both the purchaser and the vendor if required.

If the purchaser decides not to proceed with the contract, then the purchaser forfeits the 0.25% paid upon exchange to the vendor.

If the purchaser proceeds with the purchase and the cooling off period expires, the contract becomes binding between both parties. If after the cooling off period the purchaser is not able to complete the purchase for some reason and decides to rescind the contract, the purchaser forfeits the entire 10% deposit to the vendor and can be sued for damages and losses for breach of contract by the vendor.

No Cooling off Period

In some circumstances, such as auctions or the provision of a Section 66W Certificate, there is no cooling off period and the purchaser must pay the full 10% deposit immediately and the contract is legally binding on all parties. If the purchaser is not able to settle, they will forfeit the full 10% deposit to the vendor and can be sued for damages and losses for breach of contract by the vendor.

Stamp Duty

Stamp duty on the purchase contract is payable within 3 months from the date of exchange and must be paid prior to settlement. Penalty Interest is payable if it is not paid within 3 months for those contracts that have a delayed or extended settlement date. Stamp duty is calculated on the purchase price, the higher the price, the higher the stamp duty.

We will advise you how much the stamp duty is as soon as the contracts are exchanged. The First Home Buyers exemptions and other Grants from the OSR may be applicable, these change from time to time and will be discussed with you if applicable.

Searches

Once the contracts have become binding on both the parties, we will carry out the various relevant government searches like Council Certificate, Water Certificate, and Land Tax Certificate, etc and any other information that your lender may require. The searches will help calculate any outstanding bills by the vendor, and the necessary purchaser’s part of the adjustment for the bills.

Settlement

Booking settlement

Once the settlement date has approached which is usually 42 days from the date of the exchange of the contract or as agreed upon between the vendor and the purchaser and the mortgage documents have been signed and returned to the lender, we will liaise with the lender and the vendor’s solicitor to book the settlement date, time and place. We will confirm this with you in order for you to arrange the removalist if occupying the property, arranging a final inspection of the property, arranging insurance, etc. We will also inform the agent so that he can help you with the final inspection and organise arranging keys to the property on time.

Notice to Complete

If for some reason you are unable to proceed to settlement or your lender is not ready to settle, the vendor’s solicitor have a right to issue a Notice to Complete which means that we will have to settle the matter within 14 days, otherwise you will forfeit your 10% deposit. In addition to this, you will have to pay interest on the balance of the purchase price which is usually 10% per annum to the vendor starting from the day when the Notice was issued to the day settlement occurs.

The purchaser has the same right of issuing the Notice to Complete if the vendor is not ready to settle the matter but do not have the right to charge penalty interest.

Attending settlement

We will attend the settlement on your behalf and advise you that the property is officially yours once settlement is completed. We will forward an “Order on the Agent” to the real estate agent which authorises him to release the keys to you and the deposit to the vendor. All relevant government authorities will be notified of your settlement and your name will be officially added to their databases.

Maatouks Law Group is Rated 5/5 based on 80 reviews

on Google and Facebook

Get a Free Phone Consultation Now